11 Questions To Ask Yourself Before Upgrading To A Private Property

- 1 Planning To Upgrade To A Private Property? Here’s What You Should Know.

- 1.1 #1 Am I mentally prepared?

- 1.2 #2 How much total income do we need to upgrade?

- 1.3 #3 Am I prepared for the INEVITABLE?

- 1.4 #4 Can my child get into the neighbourhood schools?

- 1.5 #5 Am I willing to pay Additional Buyer’s Stamp Duty?

- 1.6 #6 Are my existing loans cleared?

- 1.7 #7 What is my Income Weighted Average Age?

- 1.8 #8 How much should I put aside for renovation?

- 1.9 #9 How much space do I REALLY need?

- 1.10 #10 How To Select A Worthy Property?

- 1.11 #11 Do you have a SOLID and CONCRETE financial plan?

- 1.12 Go ahead and ask yourself now. Am I ready to upgrade to a private property?

Planning To Upgrade To A Private Property? Here’s What You Should Know.

The Singaporean Dream?

You’ve probably heard that the Singaporean Dream now is to upgrade from an HDB to a private property.

You’ve also probably heard that you no longer need to earn at least $8,000 to $10,000 in order to afford a private property.

You see your friends are earning around the same monthly income as you and buying their first private property to live an ‘atas’ life – which made you think…

“I’m going to have a family soon and I want them to live comfortably.”

“If my friends can do it, so can I.”

Right?

Or can you?

Here are 11 questions to ask yourself before deciding to upgrade to a private property.

#1 Am I mentally prepared?

If you are ready to upgrade to a private property, you are placing yourself in a new environment once again.

Like the time when you first moved into your new BTO flat.

The new environment, new neighbours, and new travelling routes.

If you are an extrovert that can adapt quickly, then congratulations.

Your mind would go:

“Oh, I would love a new environment! I will get to meet new friends and widen my social circle. Yay!”

But if you are not?

Moving into a new environment would be like a chore to you. Having to get your hands dirty and get to know your neighbours from scratch.

Worse off?

Bad neighbours.

You know…

Those that smoke directly outside of your doorstep.

Those who play mahjong till the dusk of dawn every other night.

Those who scream at their child everyday for not eating their veg?

That’s right, you have to be mentally prepared for all these possible scenarios.

#2 How much total income do we need to upgrade?

We always tell our clients that being financially stable is essential to living a better life.

It is not just about being able to afford a private property.

It is about living a comfortable life in your new property even after paying your monthly bills, loans, and other miscellaneous costs.

Meaning, you’re still able to frequent restaurants, buy branded goods (might be for your spouse), or bringing your family for a long vacation. Even after purchasing your private property.

Think carefully, are you and your spouse financially stable enough to achieve that?

Or rather, how much do you at least need to earn?

Let’s dive deep into that with an example.

E.g. Mark is 35 years old and Sarah is 32 years old. They are thinking of upgrading and are looking at a 3-room unit in Mayfair Modern.

Price of a Mayfair Modern 3-room unit: $2,026,800

Downpayment*: $2,026,800*25% = $506,700

*excludes Buyer Stamp Duty (BSD) and Legal Fee.

Meaning, Mark and Sarah would have to pay $1,520,100 with a bank loan.

Taking into consideration that the Loan-To-Value (LTV) is 75% (for the first loan), the remaining $1,520,100 can be paid fully via a bank loan (considering that there are no existing debts).

Now the question boils down to this:

How much do Mark and Sarah need to earn in total to be eligible for the bank loan?

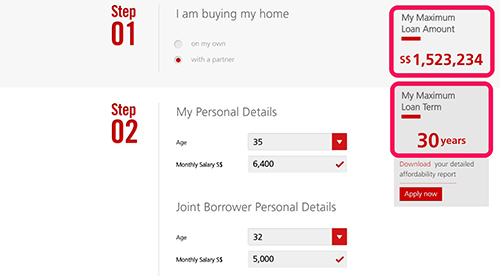

For this, we will be using DBS’ Affordability Calculator to calculate.

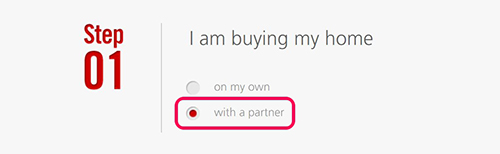

Step 1: Select “with a partner”.

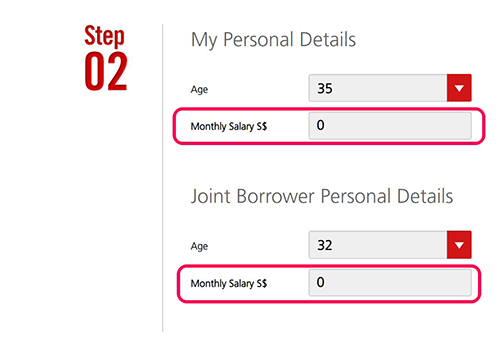

Step 2: Key in your respective ages and monthly salary.

Step 3: To find the desired loan amount, keep playing around with the monthly salary until you get it close to the remaining price (after downpayment) of the property.

And there you have it.

For Mark and Sarah, they would have to earn a total combined income of $11,400 to get a $1,520,100 bank loan with a loan tenure of 30 years.

If you and your spouse don’t qualify to get the desired bank loan amount and a loan tenure of 30 years, the initial downpayment might be too much of a burden for you to bear. Thus, you might have to sit down with your agent and discuss further on other alternatives.

Do take note that there are different eligibility, interest rates, terms and conditions for different bank loans. But they are similar more or less.

#3 Am I prepared for the INEVITABLE?

We’re just going to throw this question out to you.

What if a crisis happens after you’ve bought your property?

Crisis such as loss of income, deterioration in your health, or even family members getting hospitalized/needing treatment.

Would you be prepared for such cases where you can’t possibly prevent it?

Now, we know that no one likes to think of such taboo stuff because it frightens them.

But let’s face the reality – planning for it is better than losing your sh** when it happens.

Ask yourself this.

Why do you buy insurance for yourself, your parents, and your loved ones?

It is because you want to have a sense of assurance even if any mishap occurs.

Right?

You do not want to feel helpless and land into debts because of it.

Right?

So why not think the same when you are going through the upgrading process?

Simply read on to find out how to get that sense of assurance you are looking for.

#4 Can my child get into the neighbourhood schools?

We get it.

You want to move into a specific condo due to the availability of good schools nearby.

Education is imperative in your child’s growing up process and every parent would want the best for their child.

But what if you can’t get your child into your desired schools?

After all, getting your child into the best neighbourhood schools is not as simple as queuing up for Lim Chee Guan’s Bak Kwa – the first few 100 customers do not translate into getting a spot in the school.

Unless you have another child studying at the same school, or you are an alumni. Chances are, you will have to go through a balloting process – if there are more applicants than spots in the school.

Similar to the BTO balloting process, parents who are Singapore Citizens (SC) will be given priority over Singapore Permanent Residents (PR). For SCs who are living within 1km of the school, they will be prioritized in the balloting process.

Hence, the chances of your neighbours’ child competing with yours for the spot of the best schools nearby are very likely. (Do avoid being hostile to them)

If you wish to know more about the registration chances for Primary Schools, you may visit MOE’s website or read up on a great article on “Top tips for getting your child into popular primary schools” from 99.co.

#5 Am I willing to pay Additional Buyer’s Stamp Duty?

On 8 December 2011, our Government introduced the Additional Buyer’s Stamp Duty (ABSD) to moderate the demand for residential properties. The rates were last revised on 6 July 2018 to further stabilise the property market.

The ABSD rates can be found in IRAS’ website.

Note: We wrote about our Singapore Government’s role in the real estate market some time back. You might want to take a look to gain clarity.

So ask yourself this, are you willing to fork out an additional 12% of the property’s price to get a second home?

Or would you want to sell your existing HDB flat to avoid paying ABSD?

Ever since the ABSD rates were revised from 2013, the “Sell One Buy Two” strategy has been advocated and popularised by many real estate agents to help buyers save on ABSD.

While we practice this strategy too, we often exercise great caution to ensure buyers have the means through detailed financial planning.

Tip: Don’t be led blindly by anyone on this topic of “Sell One Buy Two”.

#6 Are my existing loans cleared?

You have been living in your BTO flat for almost 5 years now and your Minimum Occupancy Period (MOP) is almost fulfilled.

But have you cleared your existing housing loan?

The reason why we want you to ask yourself this is due to two things:

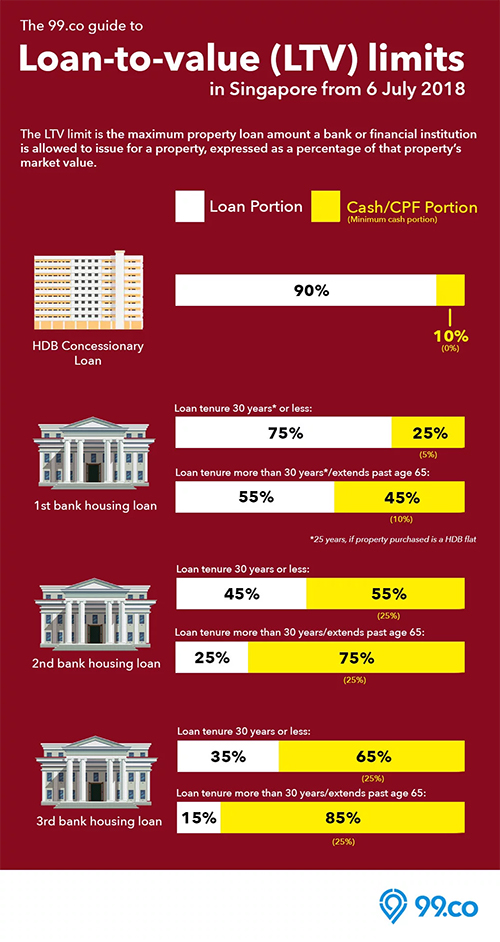

Loan-To-Value (LTV)

- LTV refers to the maximum home loan amount that a bank can grant you according to the value of the property

- Applies for the 1st, 2nd, 3rd bank loan

- The LTV limit is dependant on the loan tenure

Infographic extracted from 99.co

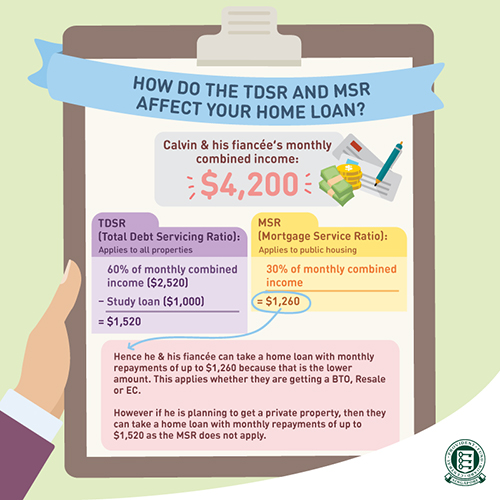

Total Debt Servicing Ratio (TDSR)

- The TDSR is a framework introduced by our Government to ensure that people borrow responsibly from banks

- It limits the amount borrowers can receive based on 60 percent of their gross monthly income

- TDSR includes study loans, credit card loans, car loans, and personal loans (basically all types of loans)

Image extracted from an initiative of the Central Provident Fund Board, ‘Are You Ready?’

It is definitely going to be a huge game-changer if your existing loans are cleared vs if it is uncleared when you’re applying for a bank loan.

Tips: You can improve your TDSR by paying off other loans.

Note: Did you know that you can rent out rooms (but not the entire flat) even before you MOP?

#7 What is my Income Weighted Average Age?

By now, you should be experiencing a splitting headache if you haven’t heard of all these terms and jargon before.

Do not worry as this will be the last jargon we are going to introduce to you today.

The Income Weighted Average Age (IWAA) refers to you and your spouse’s “income age” when banks are calculating your loan tenure.

IWWA can be calculated by this formula provided by the Monetary Authority Singapore (MAS).

(Borrower 1’s Age * Borrower 1’s gross monthly income / (Total of Borrower 1 and 2’s gross monthly incomes)) + (Borrower 2’s Age * Borrower 2’s gross monthly income / (Total of Borrower 1 and 2’s gross monthly incomes))

E.g.

Let us use back Mark and Sarah.

Mark is 35 years old and has a monthly income of $6,400. Sarah is 32 years old and has a monthly income of $5,000.

Their IWWA is as followed:

(35*$6,400 / ($6,400 + $5,000)) + (32*$5,000 / ($6,400 + $5,000)) = 33.68 (round up to 34)

With the retirement age of 65 in mind, Mark and Sarah’s maximum loan tenure will be 65 – 34 = 31 years.

We get it if some of you got confused when we started to introduce the formula. But that is what some people like to do – calculate.

A quicker way out would be to use the DBS Affordability Calculator (link above) and calculate out your maximum loan tenure.

But the importance of the IWWA is that, if your loan tenure is short, the initial down payment for your property will be increased into a huge lump sum.

#8 How much should I put aside for renovation?

You’ve seen your friends’ 3-room apartment where it was beautifully designed. You asked them how much was their renovation and they replied to you…

“Do I really need that much to renovate my private property?”

The answer is, no.

We have seen our clients renovating their new 3-room condo unit from $10,000 to $20,000, and the best thing?

It still had a contemporary and cozy look to it.

Everything from hacking, masonry, carpentry, and other electrical/plumbing works were included in the renovation.

Tip: Qanvast has this amazing renovation calculator for new home-buyers.

So how did they spend so much on the renovation?

Well, some of them might have erected a study room, dry kitchen, or even hacked down walls and merged rooms.

We do admit some home designs are out-of-this-world and dream of staying in it too.

We mean, it’s fine to renovate their home into an abode if they have the budget to do so.

But what if they plan to sell their property after 5-10 years?

They would definitely have to include their high renovation costs in their selling price.

Then the question comes:

Would buyers be willing to fork out more for the renovation?

Chances are low.

Most home-buyers would rather spend the money on something else or get their own renovation done.

We have had sellers encountering the same issue, resulting in their units being left vacant for quite some time.

In the end, the high renovation cost caused a backlash to them.

So stick with an affordable budget for your renovation.

#9 How much space do I REALLY need?

To answer this is really simple.

How big is your family?

How many rooms are you looking at?

If you have a family of three to four, chances are you are thinking of a 4-bedder.

But the question is, do you really need that many rooms?

For the benefit of those who are unaware, a 4-bedroom condo unit is different from a 4-room flat.

A 4-bedroom condo unit actually has 4 rooms, whereas the latter has only 3.

According to 99.co:

“To live in comfort, our take is that a person requires minimally 250 sq ft of space.”

Let’s take it that you have a family of three.

That will be a minimum 750 sq ft of space your family ideally needs.

Let us use back Mayfair Modern as an example – how big is a 3-bedder and 4-bedder at Mayfair Modern?

A 3-bedroom unit that costs $2,026,800 at Mayfair Modern is 958 sq ft.

A 4-bedroom unit that costs $2,564,900 at Mayfair Modern is 1,292 sq ft.

Now, will you fork out $500,000 more for that one extra room? Not to mention, the constant cleaning, maintenance, and purchase of extra furniture for that extra room.

Even if you and your spouse are planning for a second child, 3 bedrooms still seems reasonable enough to us.

#10 How To Select A Worthy Property?

If you are one of our frequent readers, you would have probably read our recent article on “How To Select A WORTHY New Launch and Unit?”

In a nutshell, before you make your decision on upgrading to a private property, there are a few things that you should take note of.

- Location

- Price

- Upcoming Developments

We have written an in-depth article on this question, so go and read it. It will be a huge help to you when choosing your next private property.

#11 Do you have a SOLID and CONCRETE financial plan?

As mentioned in #3, the key to owning that sense of assurance is to have a foolproof financial plan.

Sit down with your agent, have a long talk with him.

Tell him/her your concerns.

Tell him/her your fears.

Tell him/her that you want to know whether you can afford to take out funds readily if any crisis were to occur in the future.

Let your agent plan out in detail what could happen in each possible scenario.

E.g. If one of you were to lose your job suddenly, would you and your spouse still be able to handle the monthly loans?

Let your agent calculate it out for you. That’s their job and they are supposed to be good at it.

In fact, that’s what good real estate agents do for their clients.

They let their clients fully understand their financial situation and the kind of properties they should aim for, realistically.

They calculate out various contingency plans that could happen that would affect their clients’ life drastically.

Then, they draw out a roadmap for them.

The bottom line is, do not be afraid to show your agent that you’re vulnerable.

It’s the future of your spouse, your children, and you that we’re talking about.

It’s okay to be vulnerable now to secure your future, rather than to risk everything in the unknown future.

Go ahead and ask yourself now. Am I ready to upgrade to a private property?

We understand that after answering all these questions might cause you hesitation to upgrade…

New neighbours. Insufficient funds. Unforeseeable future leading you to sell your property. Different kinds of loans, expenses, and interest rates that stack up. Uncertainty on whether your property will make a profit or loss upon selling.

And most importantly, no availability of a foolproof financial plan.

Before reading this article, you might have thought that you could upgrade to a private property with nice facilities for your family, without any worries.

But now, the cold hard truth is laid bare in front of you.

You are unsure about whether you can afford a private property.

You are unsure about the figures – LTV, TDSR, SSD.

You are unsure whether how much you and your spouse are earning now, will be sufficient for the future.

We understand your concerns and that’s normal.

In fact, most of our clients have these concerns too.

Look, the thing is – buying a private property IS a MAJOR decision.

You’re not buying some Bak Choy from the market.

What you’re buying is, a home and a future investment, that will affect your lives in the future.

It’s alright to hesitate and worry about all these.

After all, you wouldn’t want to land your family in an ocean of debts, just for a higher quality of living.

But now, you understand more about upgrading to a private property and there’s so much more behind it.

Don’t be affected by what your friends are doing or saying. They might be telling you that owning a private property is the dream life. You then start to envy them for being able to host gatherings, and bringing their kids down for activities by the pool on a Sunday afternoon.

But here’s what you might not know.

They might be living in a private property and owning a car. But they might also be scrimping and having arguments everyday simply because of their tight budget due to their desire to live a higher standard of living.

Chances are high that they won’t show their helpless side to you.

Don’t become a slave for a desire.

It’s YOUR future and not theirs. Sit down with an expert and have them do up a proper evaluation of your current and future situations and deem for yourselves whether you’re eligible to upgrade or not.

We have helped over 300 investors and families with their financial planning. If you are interested in finding a clear financial plan for your future, we cordially invite you to a discussion!

Seek Property Advise

Seek Property Advise